What is AP Automation?

AP Automation

Accounts payable (AP) is the money a business owes its suppliers for goods and services purchased on credit. It is a current liability in the balance sheet, representing the total of approved and unpaid invoices from the suppliers. Companies must pay these unpaid invoices on time to avoid defaults. The accounts payable of a company display its short-term debt obligations and impact on cash flow. If the payables increase over time, it indicates that the company buys more products on credit. If the payables decrease, it could imply that the company is paying off its obligations faster than they purchase new goods or services on credit.

We aim for?

schedule

To make timely payments to suppliers

monitoring

To maintain accurate data that ensures proper expense management

savings

To research ways to save money

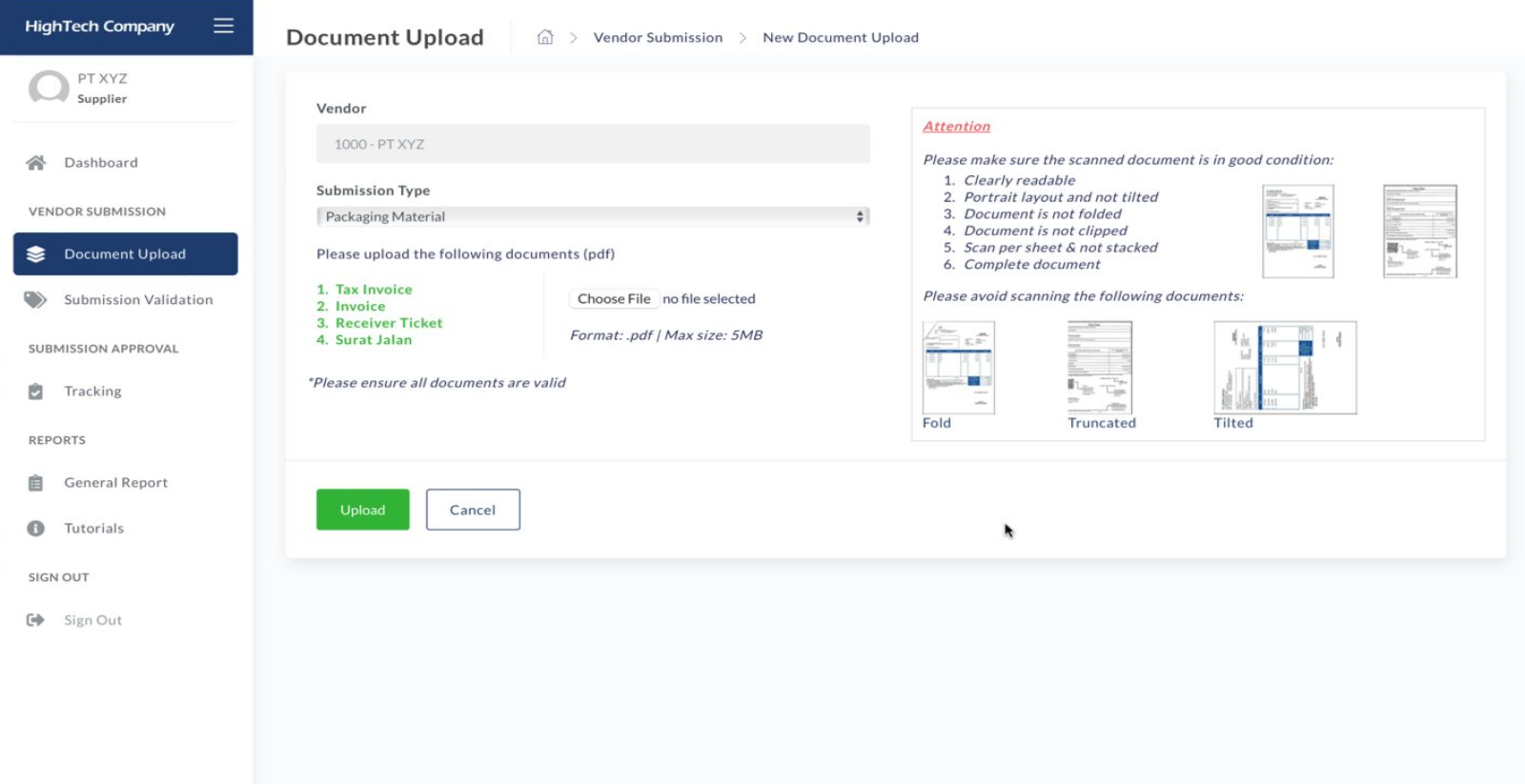

Account Payable Process

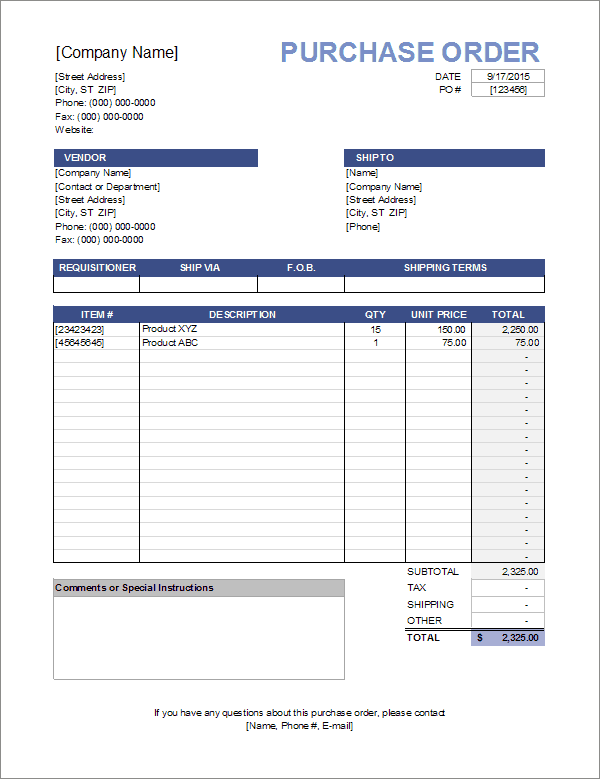

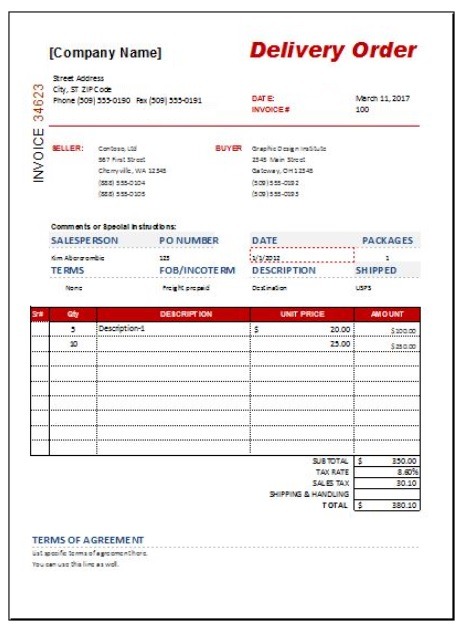

4 Way Matching

01. Purchasing Order

02. Delivery Order

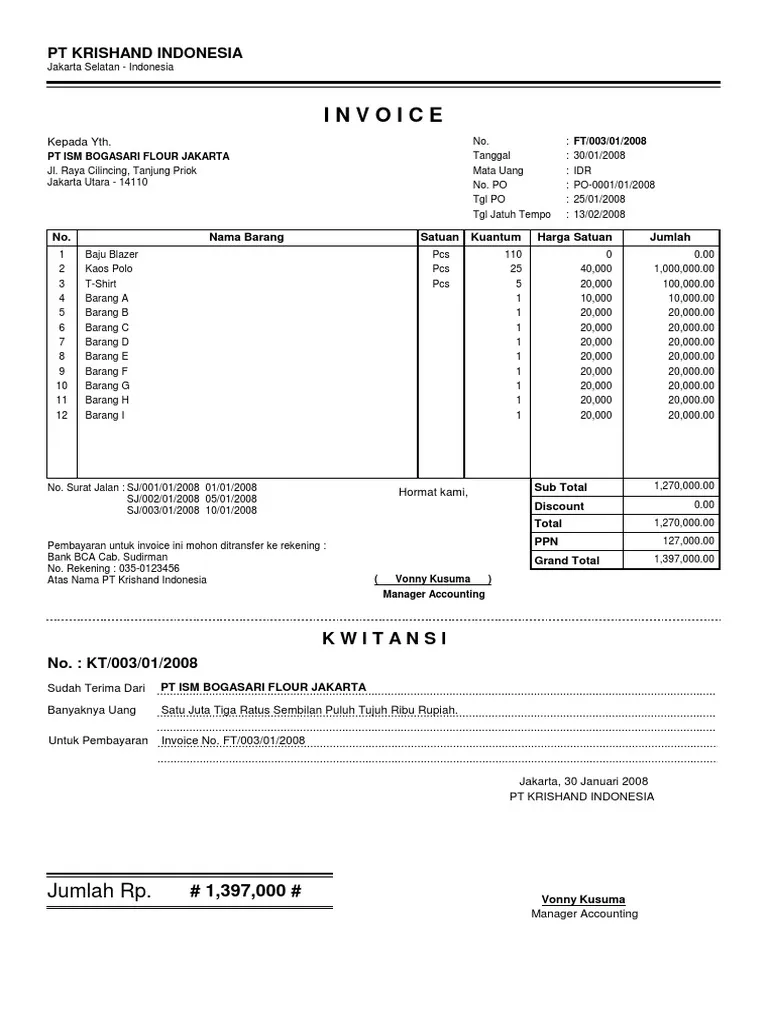

03. Invoice

04. Tax Invoice

05. Validate

AP Lifecycle

Automate with AI

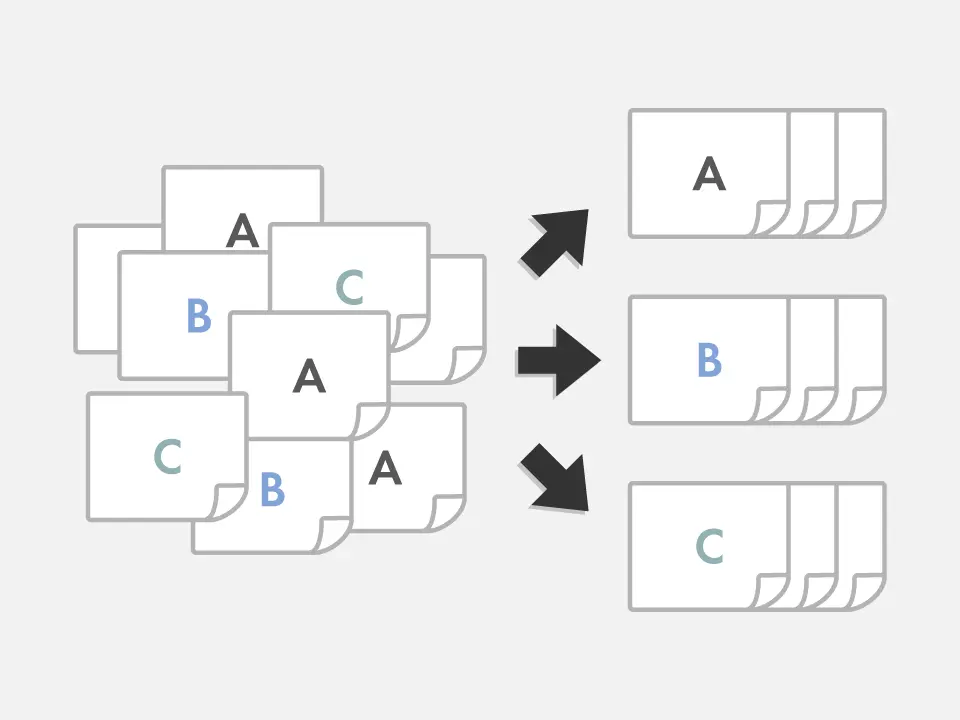

With AP automation software or accounts payable software, you can digitize invoices and automatically match to purchase orders, thereby minimizing the need for manual checks or interventions. Invoice automation and AP approval workflows can also be streamlined, ensuring prompt payments and reducing the likelihood of late fees or penalties. With real-time visibility into outstanding invoices, finance teams can more effectively manage cash flow and make better decisions concerning working capital. There are various steps in the source to pay workflow that can be further automated.

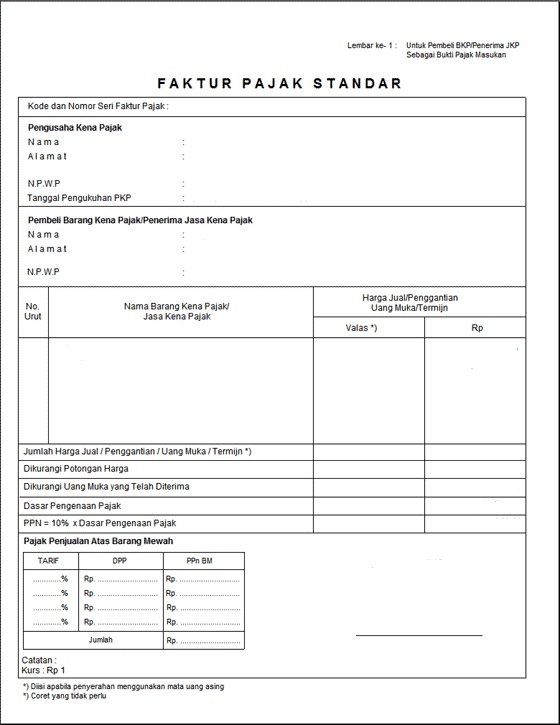

AI Document Recognition & AI-OCR

With AI Technology will automate the process using Document recognition so your supplier can easily upload bundle invoice and supporting document and system will sorter the document.

Benefits of AP Automation

check_circle

Faster invoice processing

check_circle

Lower processing costs

check_circle

Increased accuracy

check_circle

Access to an audit trail

check_circle

Faster invoice cycle times

check_circle

Enhanced visibility and reporting

check_circle