4-Way Document Matching

Our intelligent system validates documents across four critical checkpoints

Purchase Order

Goods Receipt

Invoice

Tax Invoice

Validated

AP Lifecycle

Complete AP Process Flow Visualization

Accounts Payable (AP) represents the money a business owes its suppliers for goods and services purchased on credit. It appears as a current liability on the balance sheet, showing the total of approved but unpaid invoices from suppliers.

Companies must pay these invoices on time to avoid defaults. AP levels reveal a company's short-term debt obligations and directly impact cash flow. Rising payables indicate increased credit purchases, while decreasing payables suggest the company is settling obligations faster than acquiring new credit-based goods or services.

Streamlining your accounts payable process to achieve operational excellence

Ensure prompt payments to suppliers, maintaining strong vendor relationships and avoiding late fees

Maintain precise data that ensures proper expense management and financial reporting

Research and implement strategies to reduce costs and optimize financial operations

Our intelligent system validates documents across four critical checkpoints

Complete AP Process Flow Visualization

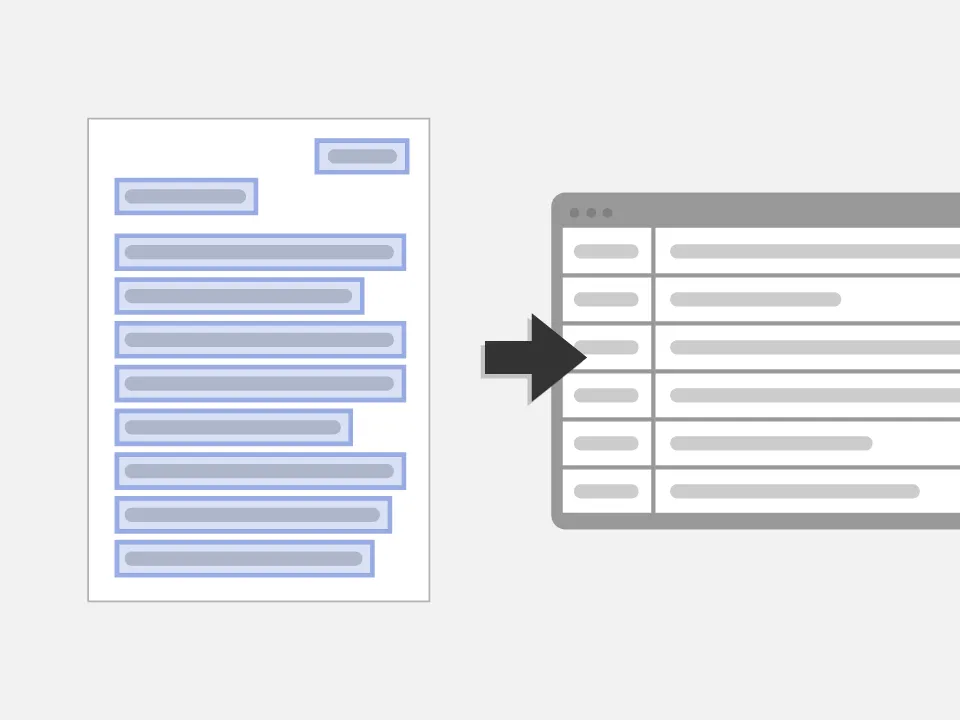

AP automation software digitizes invoices and automatically matches them to purchase orders, minimizing manual intervention. Streamline approval workflows to ensure prompt payments and reduce late fees. Gain real-time visibility into outstanding invoices for better cash flow management and working capital decisions.

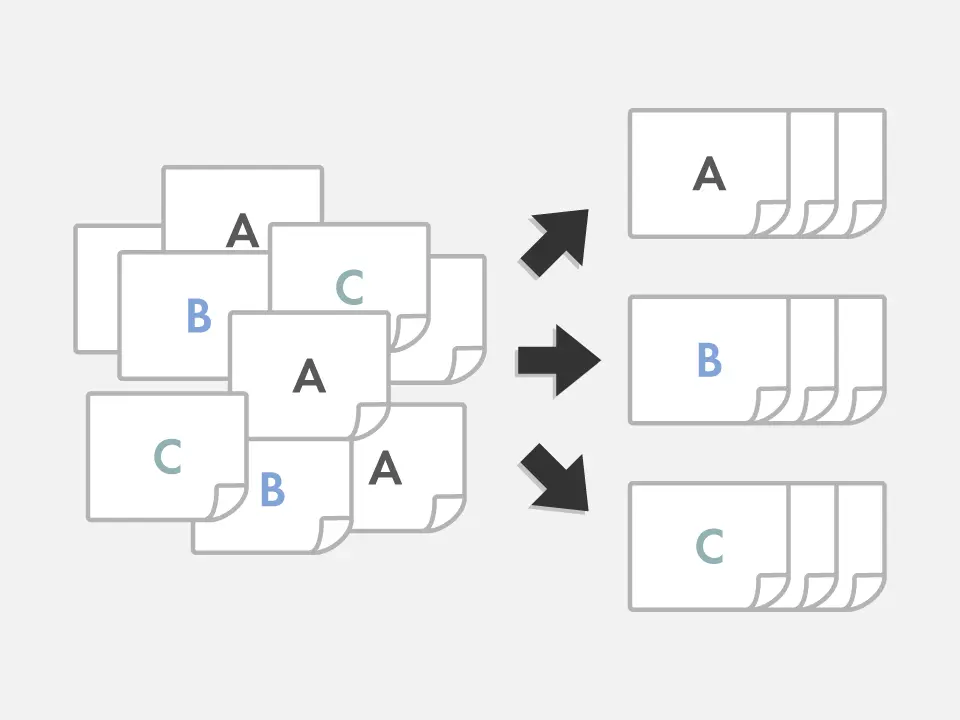

Our AI technology automates document processing through intelligent recognition. Suppliers can easily upload multiple invoices and supporting documents, and the system automatically sorts and categorizes them for processing.

Bulk upload multiple documents simultaneously

Intelligent recognition and data extraction

Transform your accounts payable process with measurable improvements

Reduce processing time from days to minutes with automated workflows

Significantly reduce operational costs through automation

Eliminate manual data entry errors with AI-powered validation

Maintain comprehensive records for compliance and auditing

Accelerate approval processes and payment cycles

Real-time dashboards and comprehensive reporting capabilities

Ensure regulatory compliance with automated checks and documentation